- 26 Sep , 2022

- Blog

A Cheat Sheet on how to Retire Early

Before you retire, it is necessary to plan your finances as you wouldn’t be able to work as efficiently & passionately as you could in your 30’s & 40’s. It is essential to have a retirement saving plan so that you don’t have to depend on anyone to support yourself.

Why retirement planning is crucial?

→ To ensure financial security once you retire

After retirement, your income will stop, and if you don’t have a sound plan on how you will manage your finance it will be very complicated to ensure financial security once you retire. You have to make sure that you have enough money to cover your expenses.

→ So you don’t rely on anyone for financial support

After you complete your retirement you might be relying on your family or friends for financial support. You have to manage expenditures with your normal savings & cash which is available at that moment.

→ Avoid headaches & worries after retirement

That is why you have to plan your retirement with sound finance investment schemes to avoid headaches & worries when you are about to retire. There are various retirement investment ways available which can help people accumulate enough fortune in the span of 10 to 20 years.

Before you begin your investment journey.

Most people want to jump straight into investing with the thought that they would attain wealth early in their life. But if you don't have a solid foundation, your investment journey will be much more difficult.

Investing in yourself means taking the time to learn about personal finance and investing. There are a lot of resources available to help you get started, and the more you know, the better off you'll be.

You should also set realistic expectations for your investment journey. Don't expect to attain a crazy amount of money to become a millionaire in a few years. Instead, focus on building a solid foundation that will help you reach your financial goals.

If you take the time to invest in yourself, you'll be setting yourself up for success on your investment journey. So before you start investing, make sure you have a solid foundation first, which is also known as FINANCIAL HEALTH.

– Build your financial health first.

Before you begin investing, make sure you are in a strong financial position so that you can enjoy the rewards of investing in the long term.

To get to the doors of financial freedom and helps you in the journey to be financially healthy.

What is financial health?

Financial health is a term that is used to describe the overall financial well-being of an individual or household.

There are many dimensions of financial health which we have to cover to achieve our financial goals and maintain financial stability when an economic crisis hits the country or when we are about to retire.

Here are a few important metrics which state your financial health.

Health Insurance Coverage - In a world where the costs of healthcare are constantly on the rise, it is more important than ever to have health insurance coverage. Unfortunately, not everyone has access to affordable coverage. This is why it is so important for everyone to have health insurance as it helps people from high healthcare costs & also helps to ensure that people have access to the care they need.

Having an emergency fund - An emergency fund can be a lifesaver during tough economic times. It can help you cover unexpected expenses without going into debt. Building an emergency fund is a smart financial move that can help you weather any storm.

Building an emergency fund is not always easy, but it is well worth the effort. Start by setting aside a small amount of money each month. Then, as your finances allow, gradually increase the amount you contribute to your emergency fund.

Saving 20% of your income - No matter how much money you make, you must always save at least 20% of your income. This will help you build up a nest egg for rainy days and other long-term goals.

Even if you are struggling to make ends meet, it is important to save as much money as you can. You may not be able to save 20% of your income right away, but you should start with whatever you can and gradually increase your savings over time.

Saving on precious metals like GOLD

- When it comes to saving in gold many people are sceptical of the idea that gold can be a good saving option for the future. Gold doesn’t go through the same fluctuations as other investment options, in fact, it’s quite the opposite when we talk about gold.

Gold is not only a good saving option but also a good way to diversify your investment portfolio. Gold is not correlated with other asset classes in any type of crisis, so it can help to balance losses in other areas of your portfolio.

Why gold can be the best saving option?

Hedge against increasing inflation - Gold has been used as a form of currency for centuries, and its value has remained relatively stable over time. At the time of inflation, gold can be a valuable hedge against rising prices. When paper currencies lose their value, gold often retains its purchasing power.

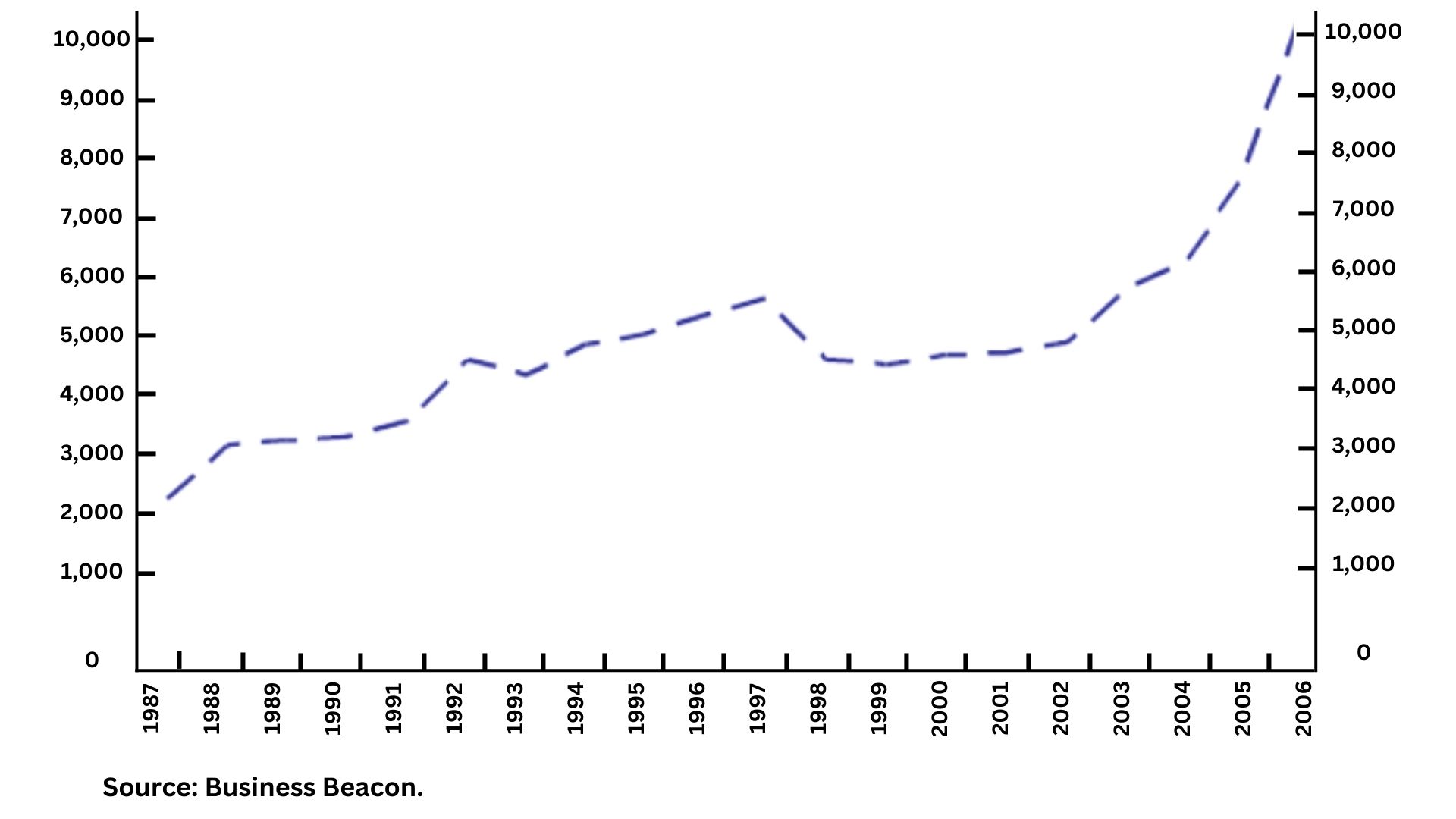

Gold prices tend to rise during an economic downturn - Gold prices have a long history of rising during economic downturns. This is because investors tend to flock to gold as a safe haven asset when the economy is struggling. Gold is seen as a store of value that can hold its worth even when other asset prices are falling.

Gold prices have climbed significantly over decades - Gold prices have been on the rise for the past decade, and show no signs of slowing down. This rise in gold prices is being driven by a variety of factors, including global economic uncertainty, inflation, and central bank buying. With so much economic uncertainty in the world today, it is no surprise that gold prices have been on the rise.

If we compare the price of Gold in past decades, there has been a drastic change:

Gold price in 1990 - Rs.3,200.00

Gold price in 2000 - Rs.4,400.00

Gold price in 2010 - Rs.18,500.00

Gold price in 2020 - Rs.48,651.00

Source - BankBazaar

So, suppose you plan to retire after 20 years and if you have started saving in gold now it can be your best investment for the future.

Develop your mindset for the challenges - Invest in yourself

To get to this level you need to develop yourself so that when you face challenges in the highly competitive world you can handle them with ease.

So here, we have a few essential tips that can be helpful on, how to invest in yourself so that you become mindful & educated before you start investing -

> Reading Self-Help Books - Everyone keeps giving this common advice to read self-help books, but have you ever wondered why?!

To develop that “MINDSET”.

Reading all those self-help books takes you through the mind of the wealthy people who have achieved wealth. Mindset is what set them apart from normal people in the journey of being wealthy. Various types of books give you distinct perspectives about building wealth, keeping your wealth & growing it as well.

> Develop good communication skills - In the increasingly competitive world, people value good communication skills in the modern era. This is because effective communication is essential to collaborating effectively with others, conveying information clearly and concisely, and achieving desired outcomes.

There are many ways to improve your communication skills. One way is to practice active listening, which involves paying attention to the person speaking, asking questions for clarification, and providing feedback.

> Maintain a healthy lifestyle

We all know that we should take care of our physical health, but sometimes it's easier said than done. Exercise, eating healthy foods, and drinking plenty of water are all essential for staying healthy, but it can be tough to stick to these habits.

That's why it's important to find ways to incorporate healthy habits into your lifestyle. Maybe you can start by walking to work instead of driving, or packing a healthy lunch instead of eating out. Small changes can make a big difference in your overall health, so don't be late, begin today for a healthy & wealthy retirement.

> Learn to manage your emotions

Your emotional health is just as important as your physical health. Learning to manage your emotions can help you stay focused and take advantage of opportunities in life.

In your investment journey, you will be facing many challenges which can make you feel that this is the end, but you have to be mentally strong as it can be difficult to see the positive things in your life.

But if you take the time to clear your mind and focus on the good, you'll be in a much better place to take advantage of what life has to offer.

> Prefer lifelong learning mindset

We believe that soon after finishing college we don’t need to learn anything. But the fact is lifelong learning is a mindset that allows you to grow and develop throughout your life continuously. It means taking advantage of opportunities to learn new things and to improve your skills.

Lifelong learning is important because it helps you stay current in your field, expand your knowledge, and build new skills to meet the challenges of an ever-changing world & also if you’re planning an early retirement.

All these points add up to make your financial health strong and sound retirement saving plan which sets you ready to begin your investment journey. These guidelines set you up to a benchmark where you can face the lethal & volatile world to become financially free & retire early.

Conclusion - We hope you enjoyed our article about how to retire early and have a retirement saving plan. We know that it is a tough journey but it is definitely possible.